What is LedgerUp?

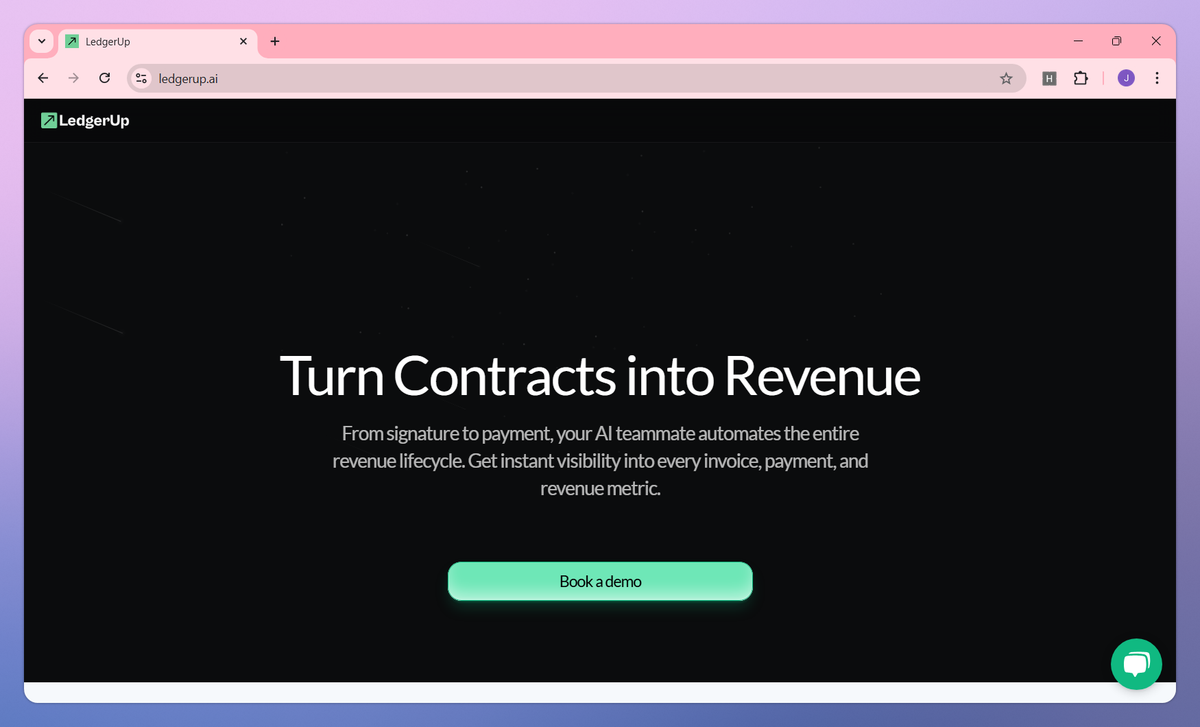

LedgerUp is an AI-powered financial automation system that transforms contracts into revenue operations. It automatically generates invoices from signed agreements, reconciles payments when received, and provides real-time visibility into financial metrics to help finance teams and founders reclaim over 40 hours monthly without adding headcount. The system connects with existing CRM and ERP platforms to maintain up-to-date financial records while catching discrepancies that might impact business growth.

What sets LedgerUp apart?

LedgerUp sets itself apart with its AI bookkeeper approach that works quietly behind the scenes, allowing founders and finance teams to focus on growth rather than invoice management. This personalized financial assistant is helpful for executives who need quick snapshots of business cash flow without leaving their usual work tools like Slack. The system functions like having another finance team member who handles the day-to-day billing tasks while providing clear, actionable insights for business decisions.

LedgerUp Use Cases

- Automated invoice generation

- Revenue tracking analytics

- Financial compliance reporting

- Cash flow monitoring

- Contract management automation

Who uses LedgerUp?

Features and Benefits

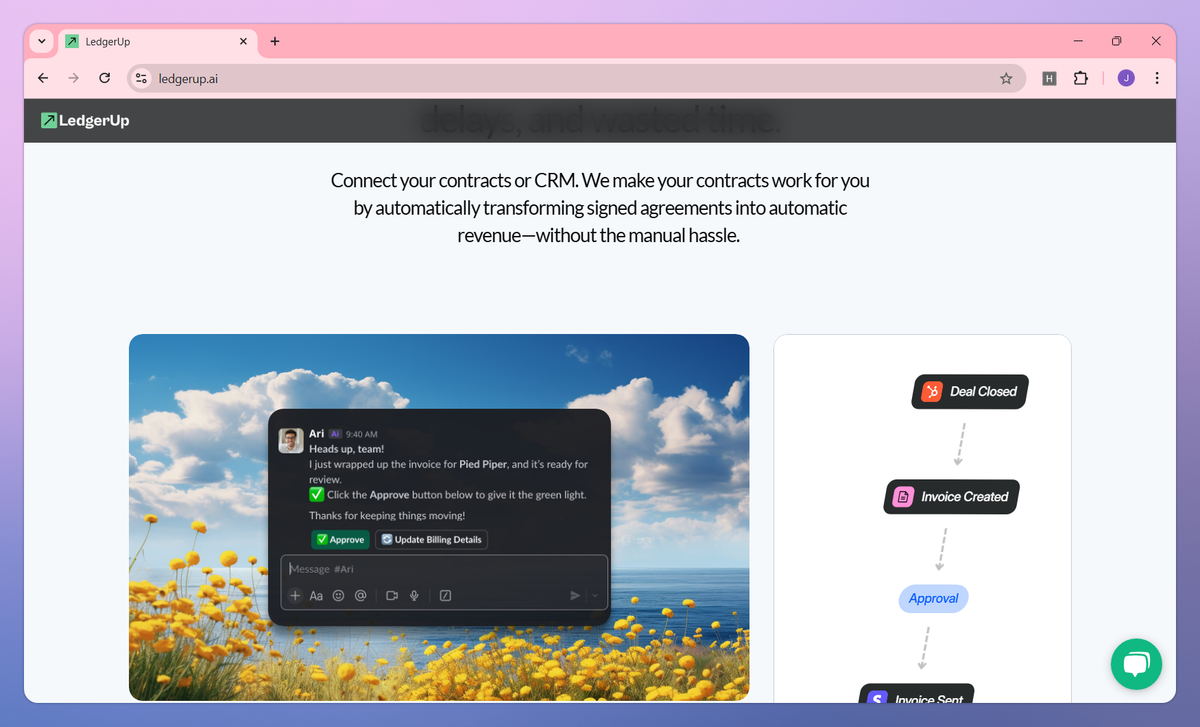

- Convert contracts directly into automated invoices, follow-ups, and payment tracking without manual intervention.

Automated Invoice Management

- Access up-to-date financial data and reports that keep your business investor-ready and compliant.

Real-time Financial Insights

- Connect seamlessly with your existing CRM, ERP, and financial tools to maintain synchronized data across platforms.

System Integration

- Track and recognize revenue automatically with precision while maintaining compliance with financial standards.

Revenue Recognition

- Reclaim 30-40 hours monthly by eliminating manual financial tasks through AI-powered automation.

Time Savings

LedgerUp Pros and Cons

Significantly improves financial tracking and reduces lag time

Provides accurate and detailed financial reporting

Offers affordable pricing compared to alternatives

Delivers timely service and results

Limited user interface functionality

Support response times can be slow

Basic feature set lacks advanced capabilities

Interface needs modernization updates

Pricing

Flat fee of $2,000

$350 per extra $500,000 in sales threshold

Example: $10M in sales results in $5,500 per month

Flat fee of $1,000 up to $5M in sales

$250 per extra increase threshold for additional sales

1.50% fee on overdue collected revenue