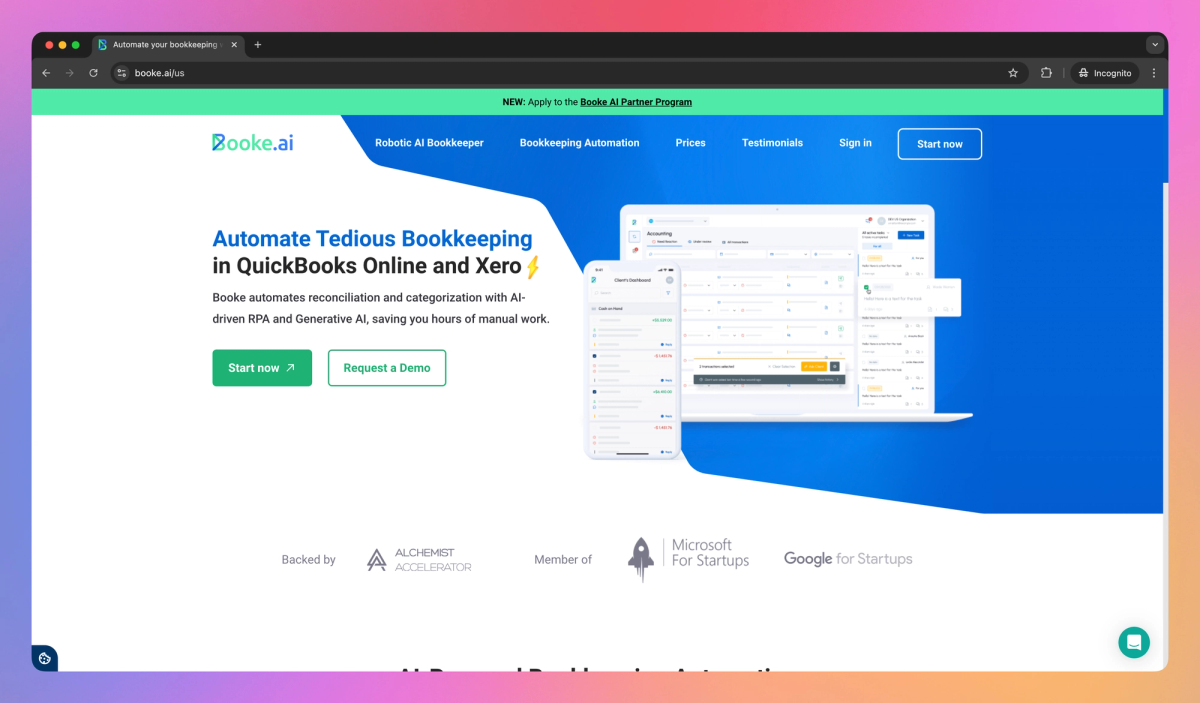

What is Booke AI?

Booke AI is an AI-powered bookkeeping automation tool that speeds up transaction categorization and simplifies client queries for accountants and bookkeepers. It extracts data from invoices and receipts, auto-categorizes transactions, and provides a one-click client communication system, allowing financial professionals to process bookkeeping tasks faster.

What sets Booke AI apart?

Booke AI stands out with its one-click client communication system, allowing accountants to quickly resolve uncategorized transactions without lengthy email chains or phone calls. This feature proves especially useful for busy financial professionals managing multiple clients simultaneously. By reimagining client-accountant interactions, Booke AI is changing how bookkeeping services are delivered in the digital age.

Booke AI Use Cases

- Auto-categorize transactions

- Extract invoice data

- Streamline client communication

- Generate financial reports

Who uses Booke AI?

Features and Benefits

- Categorize transactions up to 80% faster using AI that learns from historical data and client input.

AI-Powered Auto-Categorization

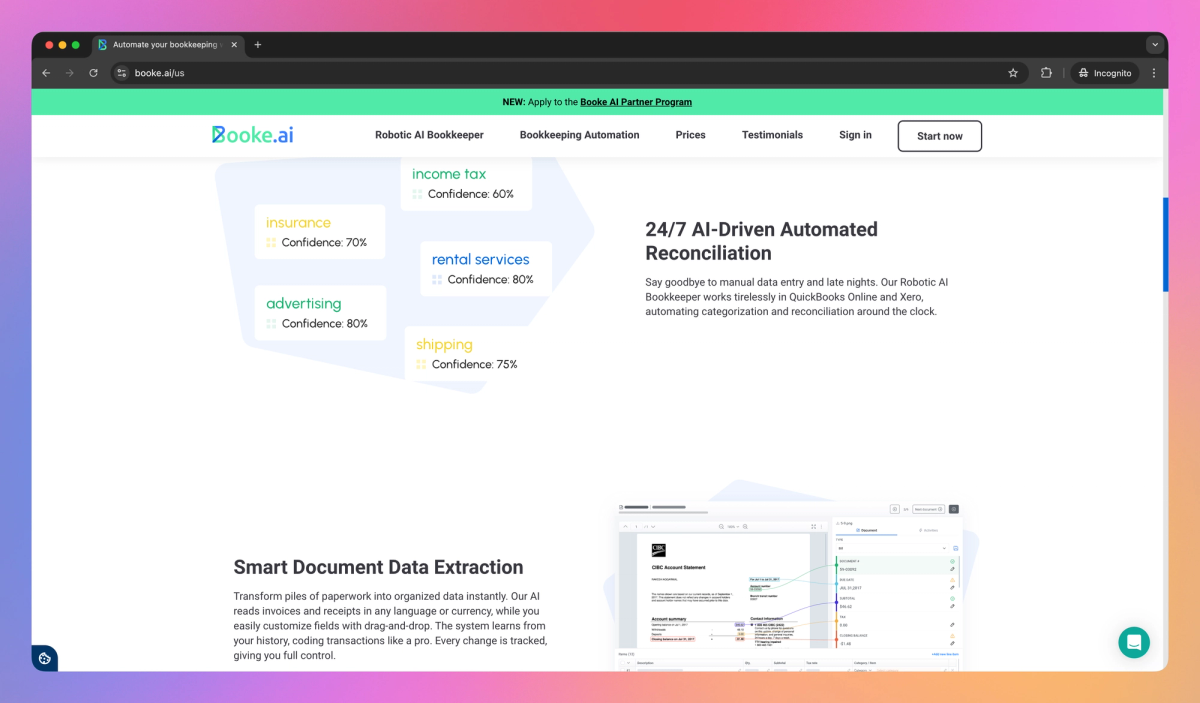

- Extract data from invoices, bills, and receipts instantly using AI-driven optical character recognition.

Real-Time OCR for Documents

- Receive AI-driven suggestions and assistance for expert reconciliation of financial data.

Intelligent Reconciliation Assistant

- Ask clients about transactions directly through the platform with a single click, streamlining communication.

One-Click Client Query Tool

- Identify and fix discrepancies in financial records automatically during month-end close processes.

Automated Inconsistency Detection

Booke AI Pros and Cons

Automates bookkeeping tasks with AI technology

Offers rapid data extraction from documents using OCR

Provides easy transaction clarification for uncertain entries

Facilitates secure file sharing and communication with accountants

Limited user feedback available for comprehensive evaluation

May require internet connection for full functionality

Potential learning curve for users new to AI-driven bookkeeping

Privacy concerns regarding handling of sensitive financial data

Pricing

Client portal (Desktop & Mobile)

Month-end close audit

Task management

Reconciliation AI-assistant

OCR AI - Automated invoices, bills & receipts processing

Secure file sharing

Dropbox & Google Drive import

Email and chat support

Browser extension: Ask Clients and perform Bulk Reconciliation

White-Label, Custom-branded Portal

Integration with QuickBooks and Xero

All Data Entry Automation Hub features

Regularly reviews new bank transactions

Auto-categorization of banking transactions

Continually self-improves with human support

Offers complete transparency with a detailed workflow

Handles daily, weekly, and monthly bookkeeping with our GPT-driven RPA

Integration with QuickBooks and Xero