What is Jarvis?

Jarvis is an AI-powered investment advisor that analyzes millions of financial data points to create personalized stock portfolios for investors. It provides 24/7 risk management and ongoing stock recommendations, allowing investors without extensive market knowledge to make informed decisions and optimize their returns.

What sets Jarvis apart?

Jarvis sets itself apart by analyzing over 40 million financial data points, giving investors without market expertise a powerful edge. This AI advisor creates tailored stock portfolios for individual risk profiles and investment goals. Jarvis continues to work for investors by providing timely stock recommendations and portfolio adjustments as market conditions change.

Jarvis Use Cases

- AI-powered stock selection

- Personalized investment portfolios

- 24/7 risk management

- Market trend analysis

Who uses Jarvis?

Quantitative Analysts Credit Analysts Research Analysts Portfolio Managers Private Equity Analysts Wealth Managers Asset Managers Risk Analysts Actuaries Economic Consultants Investment Analysts Investment Bankers Hedge Fund Managers Financial Examiners Financial Advisors Venture Capital Analysts Financial Analysts

Features and Benefits

- Analyzes millions of financial parameters to provide personalized stock recommendations.

AI-powered stock selection

- Builds a unique equity portfolio based on your risk profile and investment goals.

Customized portfolio creation

- Monitors your portfolio continuously to mitigate risks and protect profits.

24/7 risk management

- Identifies new investment opportunities and suggests portfolio adjustments as market trends change.

Timely rebalancing

- Offers fundamental, technical, and sentiment analysis to support investment decisions.

Research and analytics tools

Jarvis Pros and Cons

Pros

Helps save time on small daily tasks

Provides personalized stock portfolio recommendations

Offers AI-powered risk management system

Accessible to retail investors at affordable price

Cons

Limited user feedback available

Lack of detailed performance data

May not be suitable for experienced investors

Potential over-reliance on AI for financial decisions

Pricing

Jarvis One Stock Basic Price not available

Short-term trading

AI-powered research

Buy and sell calls

Jarvis One Stock Plus Price not available

Short-term trading

AI-powered research

Buy and sell calls

Jarvis One Stock Premium Price not available

Short-term trading

AI-powered research

Buy and sell calls

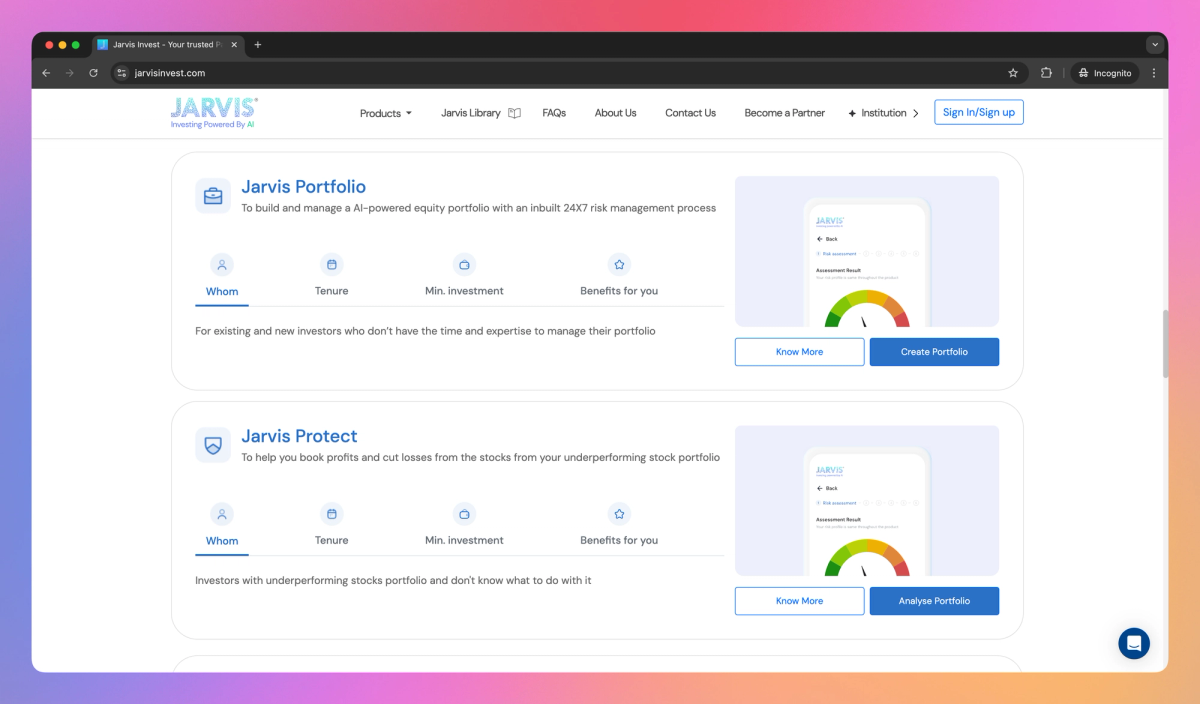

Jarvis Protect Price not available

Long-term investing

AI-powered research

Risk profiling

24x7 risk management

Rebalancing

Buy and sell calls

Jarvis Protect Plus Price not available

Long-term investing

AI-powered research

Risk profiling

24x7 risk management

Rebalancing

Buy and sell calls

Jarvis Protect Premium Price not available

Long-term investing

AI-powered research

Risk profiling

24x7 risk management

Rebalancing

Buy and sell calls

Jarvis Portfolio Price not available

Long-term investing

AI-powered research

Risk profiling

Personalized portfolio

24x7 risk management

Rebalancing

Buy and sell calls

Jarvis Portfolio Plus Price not available

Long-term investing

AI-powered research

Risk profiling

Personalized portfolio

24x7 risk management

Rebalancing

Buy and sell calls

Jarvis Portfolio Premium Price not available

Long-term investing

AI-powered research

Risk profiling

Personalized portfolio

24x7 risk management

Rebalancing

Buy and sell calls