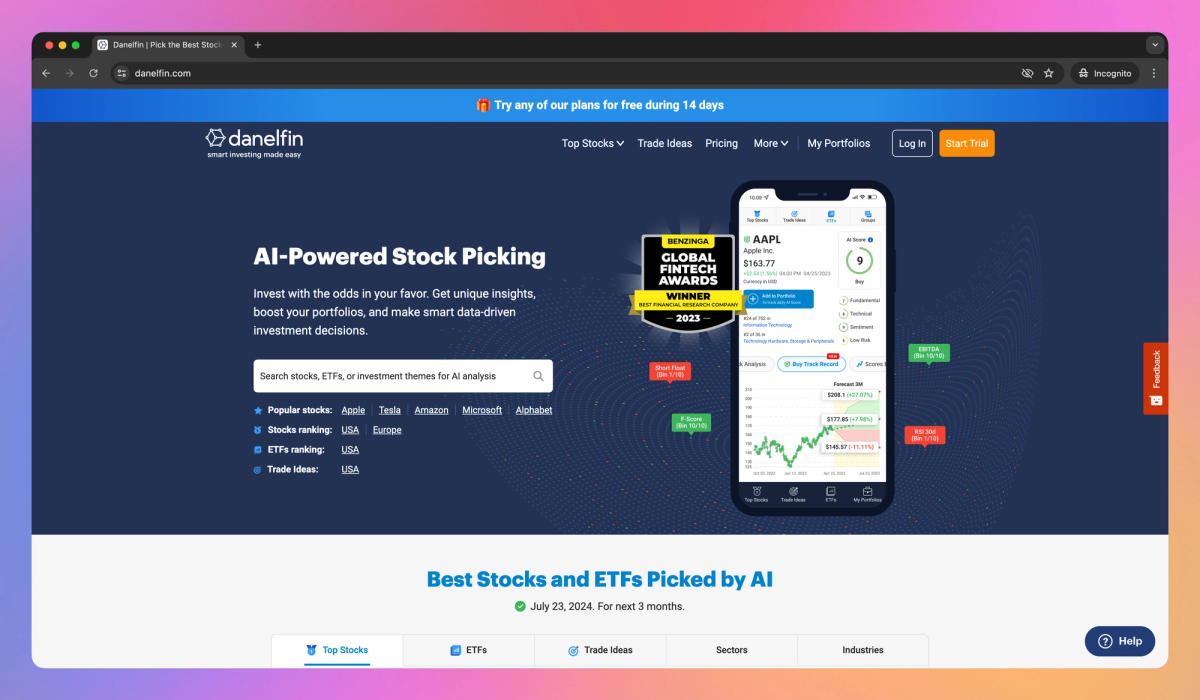

What is Danelfin?

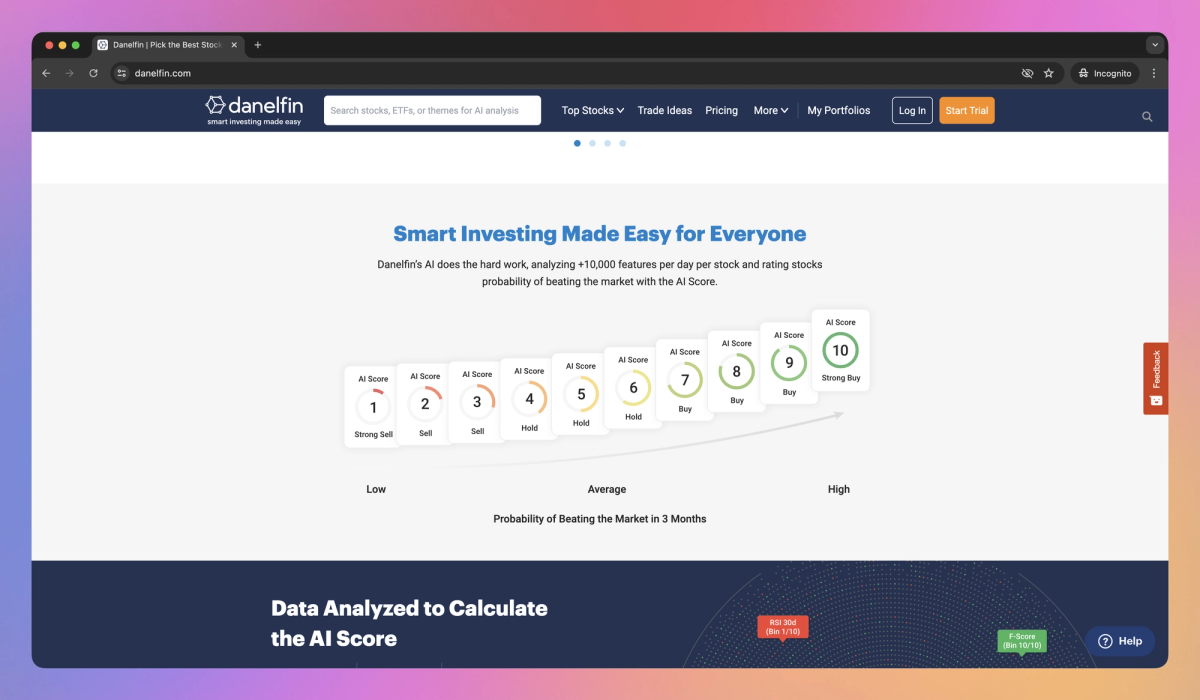

Danelfin is an AI-powered stock analytics platform that helps retail investors make data-driven investment decisions. It analyzes over 10,000 daily features per stock, calculates AI Scores to predict market performance, and provides portfolio optimization tools for investors seeking to improve their stock selection process.

What sets Danelfin apart?

Danelfin distinguishes itself by democratizing institutional-level AI technology for individual investors, enabling them to make data-driven stock market decisions. This approach proves valuable for retail traders seeking to level the playing field against large financial institutions. By bridging the gap between professional and individual investors, Danelfin offers a unique way to navigate the complexities of stock market analysis.

Danelfin Use Cases

- AI-powered stock predictions

- Data-driven investment decisions

- Portfolio optimization

- Market-beating strategies

- Risk assessment

Who uses Danelfin?

Features and Benefits

- Rates stocks' probability of beating the market in the next 3 months using advanced AI analysis of technical, fundamental, and sentiment indicators.

AI Score

- Provides comprehensive rankings of stocks and ETFs across multiple markets, helping identify top investment opportunities.

Stock Rankings

- Offers potential trade suggestions based on AI analysis, including historical performance and future forecasts for stocks.

Trade Ideas

- Enables creation and monitoring of stock portfolios with AI-powered insights and alerts for optimal performance tracking.

Portfolio Management

- Provides transparent explanations of the factors influencing AI Scores, allowing for better understanding of stock analysis.

Explainable AI

Danelfin Pros and Cons

Provides AI-powered stock analytics for data-driven investment decisions

Offers comprehensive analysis of fundamental, technical, and sentiment data

Easy-to-use interface with clear presentation of information

Helps investors discover and evaluate a wide range of stocks

Constantly improving platform based on user feedback

Excellent customer support

European stock ratings can be volatile and change frequently

Limited customization options for portfolio tracking

Learning curve may be steep for novice investors

Does not provide real-time trading capabilities

Pricing

Free TrialTop 10 stocks to buy daily newsletter

10 stock/ETF reports per month

Top 10 ETFs in ranking

Top 10 stocks in ranking

Top 3 sectors and industries to invest in

1 portfolio, 5 stocks/ETFs per portfolio

Top 2 Trade Ideas

Top 10 stocks to buy daily newsletter

Unlimited stock/ETF reports

Unlimited ETF rankings

Unlimited stock rankings

Unlimited top sectors/industries rankings

5 portfolios, 30 stocks/ETFs per portfolio

Top 25 Trade Ideas

Top alpha signals

Top 10 stocks to buy daily newsletter

Unlimited stock/ETF reports

Unlimited ETF rankings

Unlimited stock rankings

Unlimited top sectors and industries rankings

Unlimited portfolios and stocks/ETFs

Unlimited Trade Ideas

Top, technical, fundamental, and sentiment alpha signals

Export to CSV (stock scores and indicators)

Historical daily AI Scores since 2017 in CSV, on request

Trading Parameters for stocks/ETFs with Buy Track Record