What is AlgosOne?

AlgosOne is an AI-powered trading system that automates analysis and execution across cryptocurrency, forex, and stock markets. It offers investors and traders automated risk management tools and claims an over 80% trade success rate, allowing them to grow their portfolios without manual market monitoring or strategy development.

What sets AlgosOne apart?

AlgosOne stands out as a licensed platform, providing a secure environment for financial transactions. This AI-powered system opens doors for busy professionals who lack extensive market knowledge but want to grow their wealth. AlgosOne's reserve fund adds an extra layer of protection, compensating users for losing trades and safeguarding balances against unexpected events.

AlgosOne Use Cases

- AI-powered trading automation

- Crypto market analysis

- Forex risk management

- Stock portfolio diversification

Who uses AlgosOne?

Features and Benefits

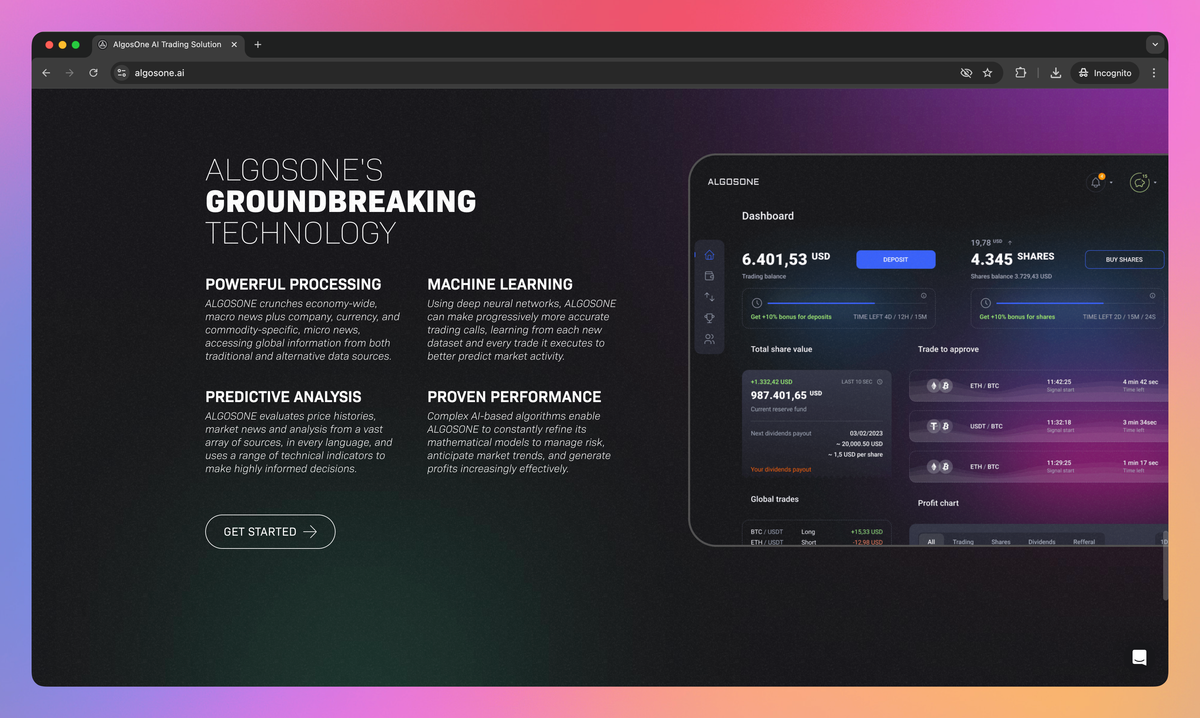

- Utilizes advanced artificial intelligence to analyze market data and execute trades across multiple financial markets including stocks, forex, and cryptocurrencies.

AI-Powered Trading

- Implements AI-driven risk mitigation strategies to protect investments and optimize profit potential.

Automated Risk Management

- Offers trading across a diverse range of assets including cryptocurrencies, forex pairs, and stocks from various sectors.

Multi-Asset Portfolio

- Provides a simple setup process where users can start trading without needing to program strategies or manage trades manually.

User-Friendly Platform

- Operates as a registered financial services provider, adhering to regulatory standards for user protection and secure trading.

Licensed and Regulated

AlgosOne Pros and Cons

Pros

Offers AI-powered crypto trading and wallet management

Provides automated trades with potential for high returns

Regulated company with security measures in place

User-friendly interface suitable for beginners and experts

Cons

Long lock-in periods for investments (12-24 months)

High early termination fees (30% or more)

Limited flexibility in trade scheduling

Significant trading fees impact overall profitability